Momentum Grows for FM in Smartphones

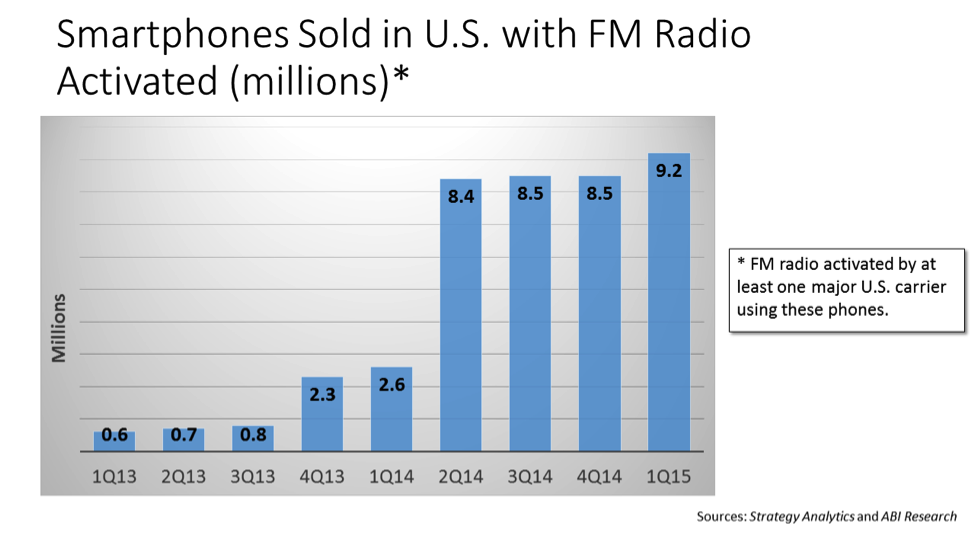

There’s been good news recently for advocates of activating FM radio receivers in smartphones. First came the announcement by AT&T Wireless—the #2 wireless carrier in the U.S.—that it will request its Android phone manufacturers to activate FM reception capability on all their devices in 2016 and beyond. Next, NAB Labs released its latest tracking data of activated FM capability in U.S. smartphones, which showed continued growth in early 2015, reaching the highest percentage of phones sold in any calendar quarter to date (see chart below). And most recently, T-Mobile joined the party, essentially matching AT&T’s move toward pushing its Android platform providers to activate the FM chip in all future devices it provides the carrier. This now represents a significant tipping point in the FM-activation battle, with the majority of U.S. wireless providers now supporting the activation of FM receivers in their smartphones.

The chart above shows the impact of wireless carrier Sprint’s arrangement with broadcasters to have its device suppliers activate FM on their smartphones. The strong growth this deal engendered in 2014 can now be seen to continue into 2015, with over 9 million smartphones sold in the U.S. with their FM capability fully activated by at least one U.S. wireless carrier during 1Q15. Given that only about 2.6 million such phones were sold in 1Q14, this reflects a growth rate of over 350% year-to-year, mostly resulting from Sprint’s action.

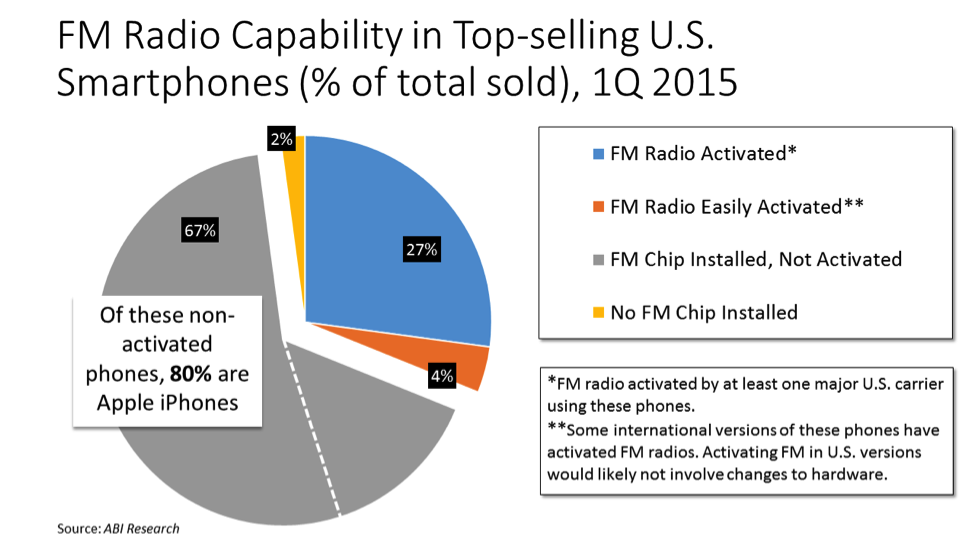

Further, the 9.2 million smartphones sold with FM activated by at least one carrier in 1Q15 represented 27% of all phones sold during the period (see chart below). While there’s still a long way to go, this is the highest percentage of total U.S. smartphone sales ever recorded by FM-activated units since NAB Labs started tracking this item in 2012.

The Sprint-driven growth in FM-activated smartphone sales included the preloading of the NextRadio app in essentially all of its smartphones except the iPhone (more on that in a moment). The impact of this deal with a single, smaller carrier will likely be significantly amplified in 2016, when AT&T’s and T‑Mobile’s moves to activate FM on all their Android phones hit the market. This implies that the current growth in FM activation in smartphones will continue to accelerate.

By the way, both AT&T and T-Mobile already offer a few phones with activated FM receivers (although none include the NextRadio app preloaded yet—users can download it from an Android app store and it will work on most of these phones). But a recent scan of the AT&T website showed that among its 28 currently available Android phone models, only 5 had FM activated—and most of these were not among its best-selling models. If AT&T’s and T-Mobile’s new announcements bear full fruit, therefore, the number of additional FM-activated phones in 2016 should be substantial.

At present, this leaves Verizon as the sole U.S. major wireless carrier that has not supported FM activation in its smartphones. Verizon is the largest U.S. carrier (by subscribers), and it has traditionally been the least supportive of FM activation in its devices, so a major challenge among carriers remains. The AT&T and T-Mobile actions will add to the Sprint installed base and push the percentage of FM-activated smartphones toward a majority position, however, perhaps making it difficult for Verizon to persist in isolation with its anti-FM position.

Nevertheless, the bigger challenge to making FM activation a default condition among smartphones remains with Apple. The multiple models of iPhones on sale currently account for about half of the entire smartphone market’s sales (by units), and unlike most other smartphone manufacturers—which either enable FM unilaterally, or at the request of the wireless carriers they sell to—Apple has never activated FM radio on any iPhone, although they all have contained an FM receiver chip since the iPhone 3GS. Meanwhile, other Apple products, like several recent generations of the iPod Nano, do include a high-performance FM receiver, so it’s obvious that Apple can develop a great FM radio experience in its devices. The iPod Nano has no WiFi or other wireless network connectivity, though, so Apple’s strategy seems to be based consistently on the premise that if the device can be network-connected, it shall have no working FM radio. Apple must have its reasons for this, likely due to its unique position of being both a consumer electronics manufacturer and an entertainment service provider, but this renders the wireless carriers who want to activate FM on their smartphones unable to do so on any iPhone at present.

Another recently discovered item in NAB Labs’ research is that one of the top-selling smartphones in 1Q15 included a new connectivity chip that—unlike all other top-selling models—does not include an FM radio receiver. The Motorola DROID Turbo, so far available exclusively through Verizon, uses a Qualcomm Atheros QCA6164 chip for its WiFi and Bluetooth connectivity, with no FM radio bundled into the silicon (as all other current connectivity chips do). If this departure from common practice becomes a trend, the climb toward activating FM in most smartphones could become steeper, moving from simply activating hardware already on board to requiring installation of additional hardware.

So while the numbers are improving and alliances are growing, the situation remains fluid, and the battle to activate FM in smartphones will continue on two fronts: with wireless carriers (primarily Verizon) and with smartphone manufacturers (primarily Apple).